Credit Cards provide over 45 days of interest-free loans. So, many people use this interest-free period to earn returns by trading or investing that money.

But that’s not a good practice unless you’re highly experienced in stock market trading. It may impact your trading psychology, and you end up losing your capital.

If you’re experienced and know risk management and money management, you can transfer money from your credit card to your Zerodha account.

Zerodha doesn’t accept payment from credit or debit cards; hence you can not directly add money from your card.

But, some third-party apps allow sending money from Credit Card to a savings bank account; later, you can transfer that to Zerodha via Netbanking or UPI.

Contents

- Can Funds Be Transferred To Zerodha Account With Credit Card?

- How To Transfer Money From Credit Card To Demat Account?

- How To Transfer Money From Credit Card To Bank Account?

- Can We Transfer Money From Credit Card To Demat Account Directly?

- Is There Any Way To Transfer Money From Credit Card To Bank Account Without Any Charges?

- How To Add Funds From Bank Account To Zerodha Demat Account?

- Conclusion

Can Funds Be Transferred To Zerodha Account With Credit Card?

No, you can not add money to Zerodha from a Credit or Debit card. You must transfer money from your linked bank account to add funds to your Demat account. If you want to add from another account, then first link that as a secondary account in Zerodha.

How To Transfer Money From Credit Card To Demat Account?

There is no direct way to transfer money from Credit Card to a Demat account because no stock broker supports Credit/Debit Cards.

However, you can transfer money from your Credit Card to your bank account via the rent pay service of CRED, No Broker, MagicBricks, Freecharge, Paytm, PayZapp, etc.

Once your savings account is credited with rent payments, you can transfer that fund to your Demat account.

But it’s not advisable to do so because it is a loan with a higher interest rate. If you don’t repay your credit card bills on time, you end up paying a higher interest rate (up to 36% p.a), and missed bills will also ruin your CIBIL score.

How To Transfer Money From Credit Card To Bank Account?

If you still want to proceed, here is the step-by-step process to transfer money from your Credit Card to your bank account:

You should have one of the following apps installed on your smartphone-

- CRED

- Paytm

- PayZapp

- No Broker

- Freecharge

- PhonePe

- ePayRent

- MagicBricks

- RedGiraffe

- Housing.com

Follow these steps to transfer money from your credit card to your bank account via CRED:

1. Install CRED

Go to Google Play Store (Android) or Apple App Store (iPhone) and install the CRED application on your smartphone.

2. Open CRED

Go to your Apps list and open CRED. Log in with your phone number and add the credit card.

3. Tap on Pay

Once you log in to CRED, you’ll see the ‘Pay‘ option in the bottom navigation bar.

4. Select Rent Payment

You’ll see the Rent Payment option on your phone screen. Tap on the Rent Payment option to proceed.

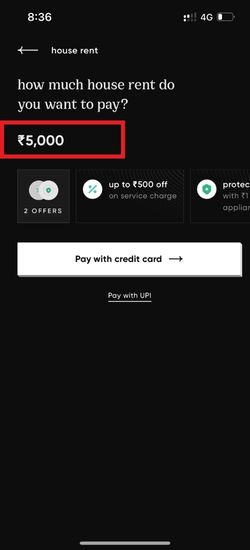

5. Enter the Amount

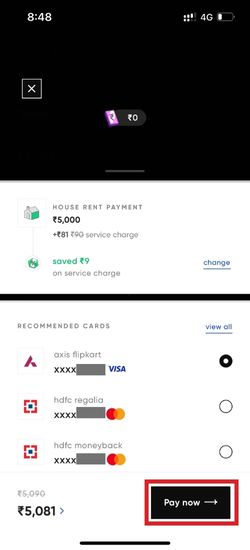

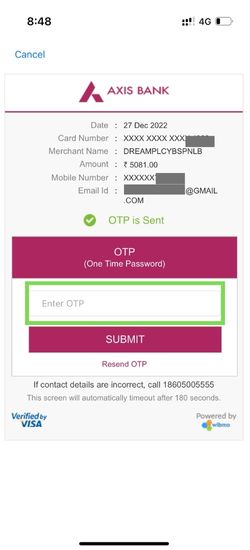

Enter the amount you want to transfer from your credit card to your bank account. I’m entering ₹5000 for demonstration purposes. You can enter any amount that you want to transfer.

6. Enter the Name

Enter the name registered in the bank account where you transfer the money. Don’t use your name because CRED will not allow payment to self-account. So, I recommend using your family members’ accounts.

7. Enter Bank Account Details

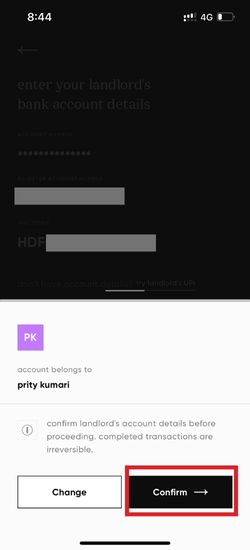

Enter bank account details where you’re paying. Correctly enter the bank account number and IFSC code, or you can also enter the UPI address.

8. Confirm the Account Details

Once you click the Proceed button, CRED will fetch the payee name and ask you to confirm the details. Tap on Confirm to proceed.

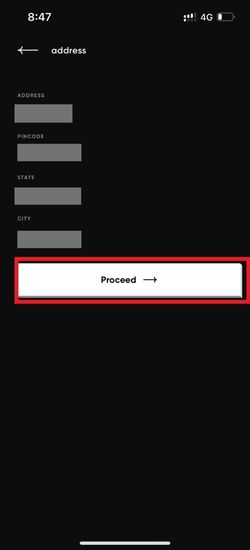

9. Enter the Address

Enter your address with the area PIN code.

10. Select Credit Card

Select the Credit Card from which you want to deduct the money and tap on Pay Now.

11. Enter OTP

CRED will send you a payment OTP on the registered mobile number. Enter the OTP to complete the payment.

12. Check Your Account

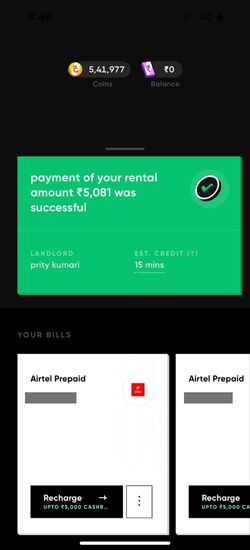

Once you finish the payment, it’ll take approx 15 minutes to complete the rent payment process. You’ll receive a confirmation message once the amount is credited to the bank account.

Now you can transfer that fund to your primary bank account linked with Zerodha and add funds for trading and investments.

Can We Transfer Money From Credit Card To Demat Account Directly?

No! SEBI (Security Exchange Board of India) doesn’t allow stock brokers to add money from credit cards to the Demat account. So, you can not transfer money directly from a credit card to your Demat account.

Is There Any Way To Transfer Money From Credit Card To Bank Account Without Any Charges?

All payment services charge an additional fee for rent payments. Earlier, CRED and No Broker used to allow transferring money from credit card to bank account without any charges, but now it’s not possible.

You can use the No Broker rent payment service for lower charges and transfer funds from your credit card to your bank account.

How To Add Funds From Bank Account To Zerodha Demat Account?

Adding funds from your bank account to your Zerodha Demat account is easy. Follow these steps to add funds from your bank account to Zerodha:

1. Log in to Kite

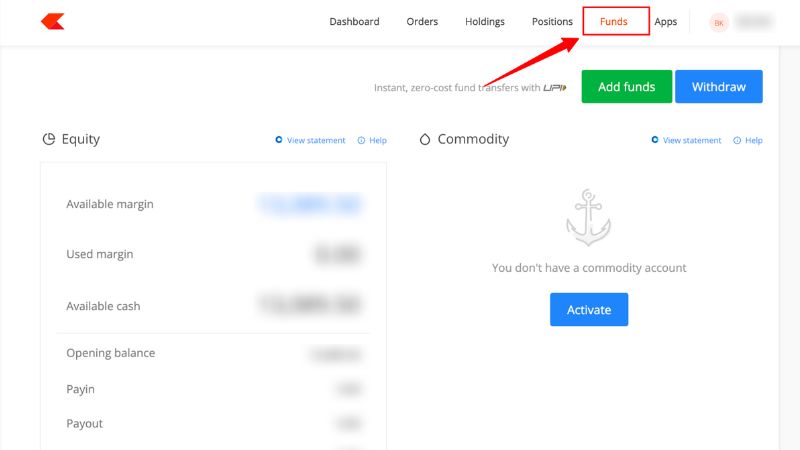

Go to kite.zerodha.com and enter your Client ID and Password.

2. Go to Funds

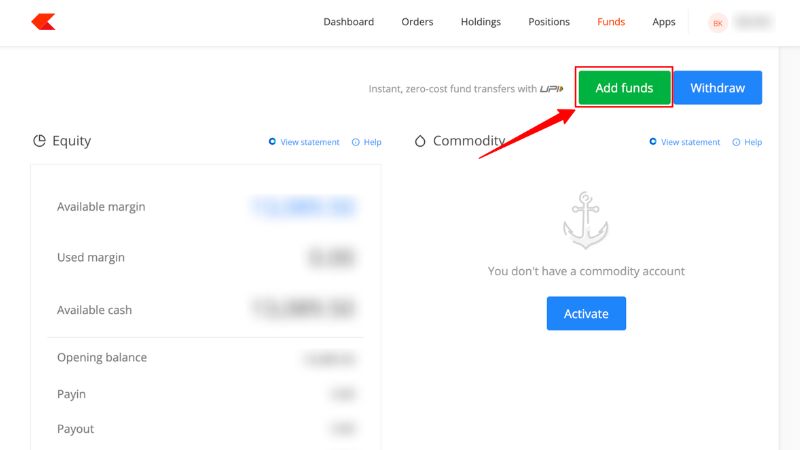

Click on Funds from the top navigation menu.

3. Click on Add Funds

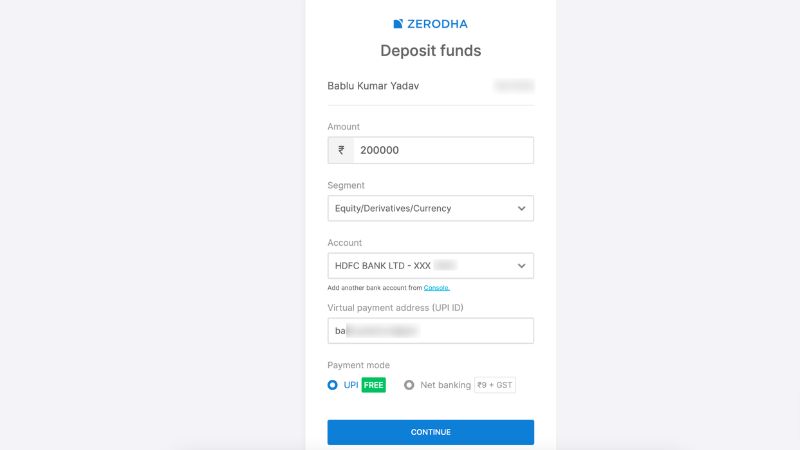

4. Enter the Amount

Enter the amount you want to transfer from your bank account to Zerodha. Select your bank account and payment method. I prefer UPI payment because it has no transaction fee.

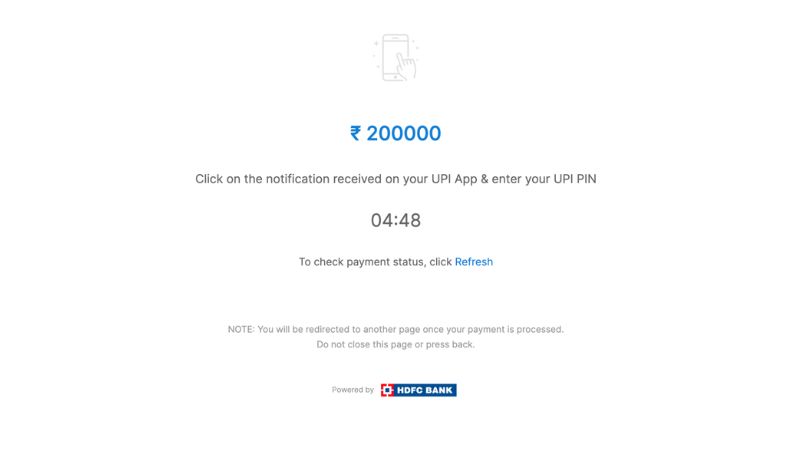

5. Complete the Payment

Go to your UPI app and finish the payment by entering your UPI PIN.

Conclusion

SEBI doesn’t allow payment to a Demat account from Credit Cards. But you still can use CRED rent payment services to transfer funds from your credit card to your bank account and then add this to your Zerodha or any other Demat account for trading.