Futures and Options are derivates in the stock market, and many traders prefer to trade in FNO. All major discount brokers allow F&O trading, including Zerodha.

If you don’t want to trade Futures and options, you can temporarily disable it from the Zerodha dashboard.

In this guide, I’ll teach you the step-by-step process to close F&O in the Zerodha Kite trading platform.

Also Read: How To Close Commodity Account in Zerodha

Contents

- How To Close Futures and Options in Zerodha?

- Step 1- Click on the dropdown icon at the top-right corner

- Step 2- Click on the Console

- Step 3- Click on Login with Kite

- Step 4- Enter your Client ID and Password

- Step 5- Enter login PIN

- Step 6- Click on Account

- Step 7- Go to Segments

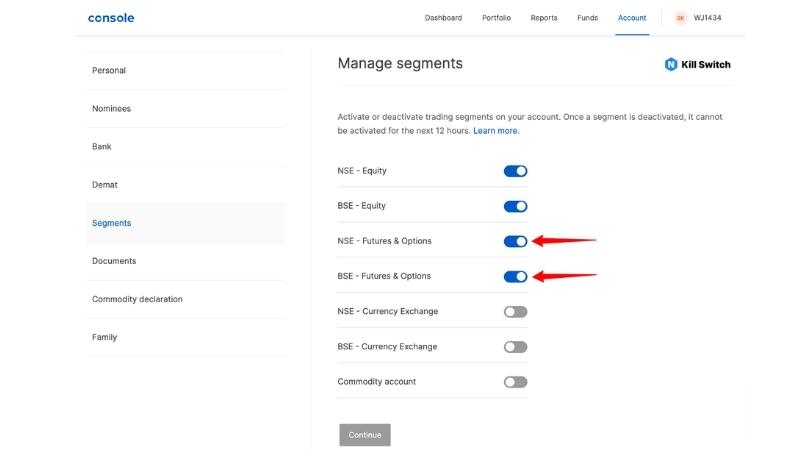

- Step 8- Toggle off the NSE – Futures & Options icon

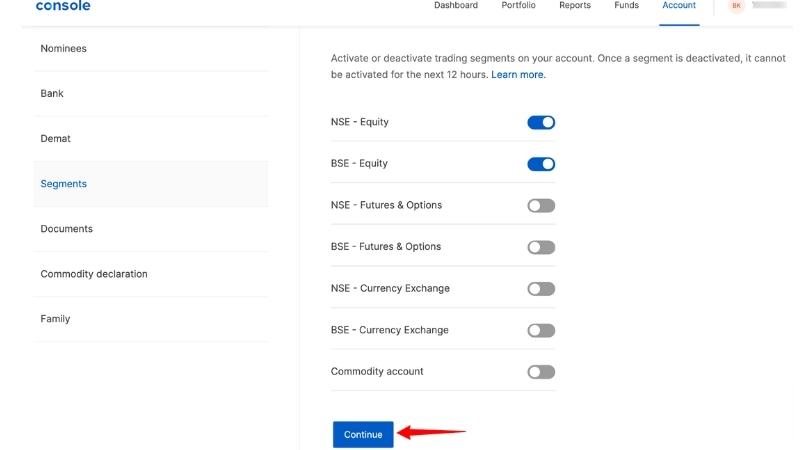

- Step 9- Click on the Continue button

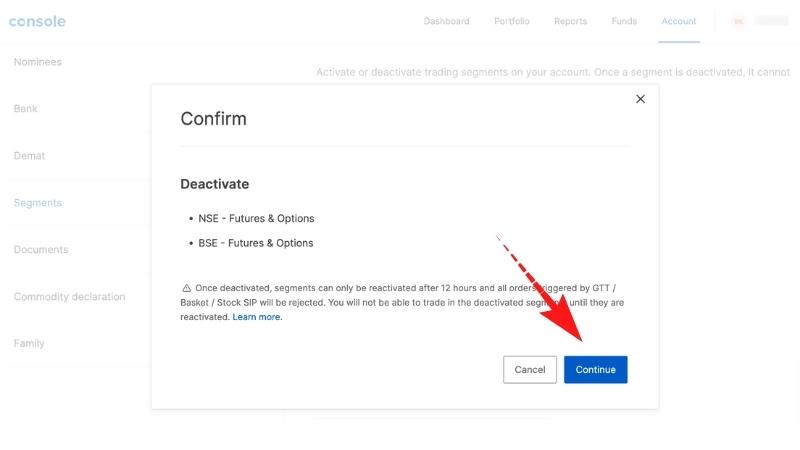

- Step 10- Confirm again to deactivate the account

- Why Should You Deactivate Your Futures and Options Account?

- What Are The Brokerage For Futures and Options in Zerodha?

- How To Trade Futures and Options in Zerodha?

- How To Activate F&O in Zerodha Without Income Proof?

- Conclusion

How To Close Futures and Options in Zerodha?

Intraday trading in F&O is risky if you’re not psychologically strong. Hence, many experts recommend disabling F&O once you’ve booked the profit.

Go to Zerodha’s official website and follow these steps to close your Zerodha’s F & O account-

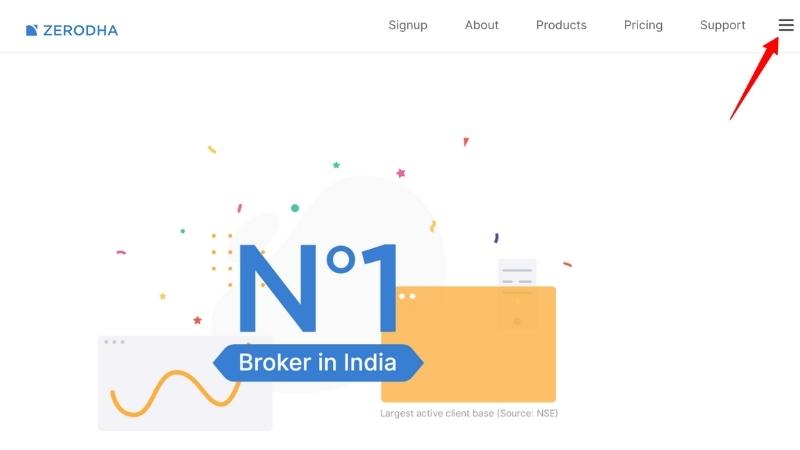

Step 1- Click on the dropdown icon at the top-right corner

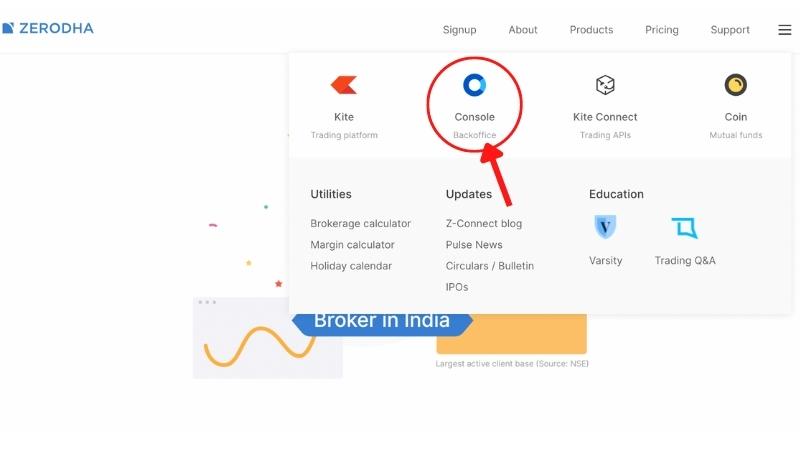

Step 2- Click on the Console

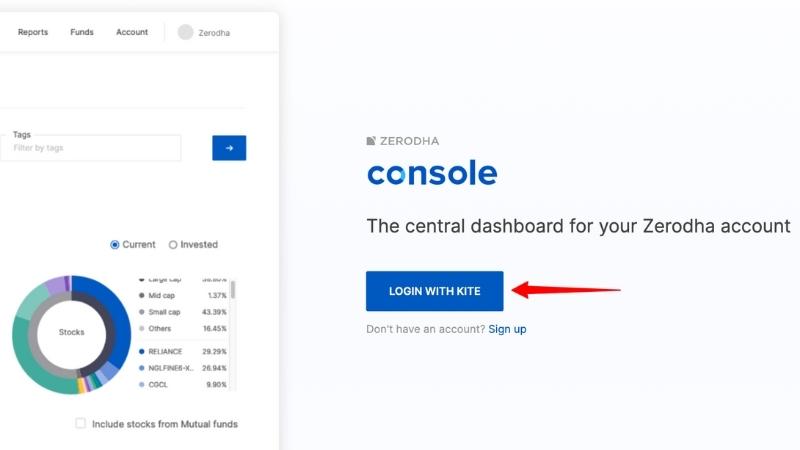

Step 3- Click on Login with Kite

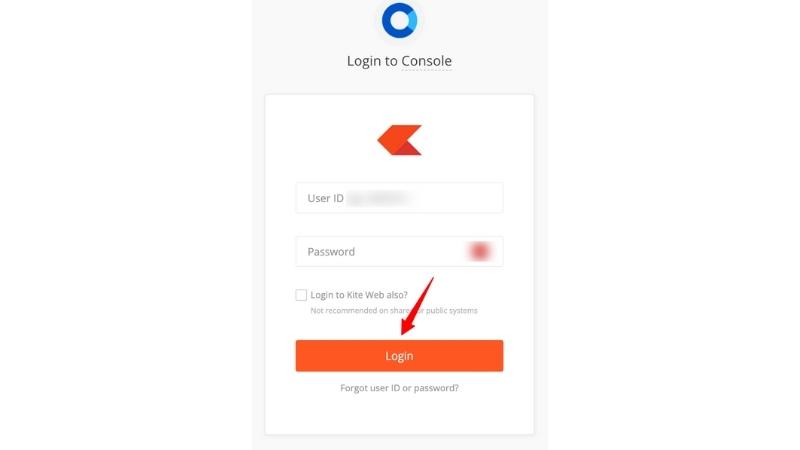

Step 4- Enter your Client ID and Password

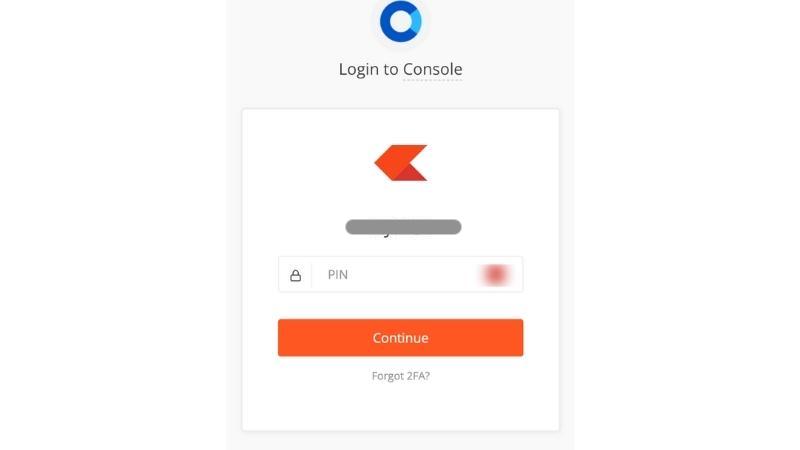

Step 5- Enter login PIN

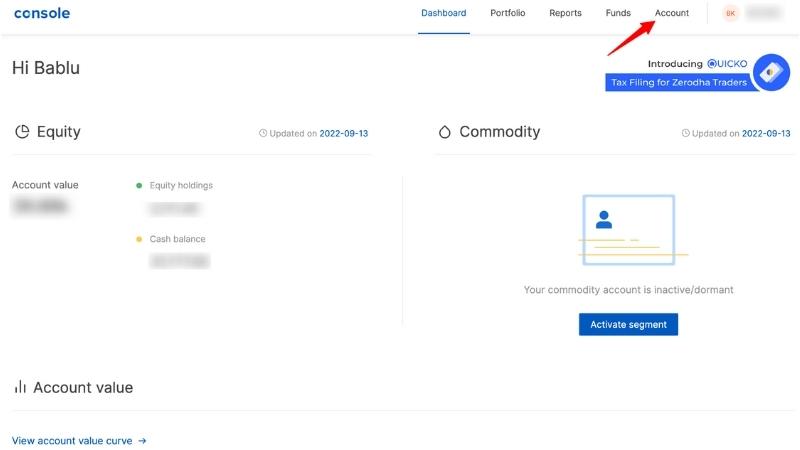

Step 6- Click on Account

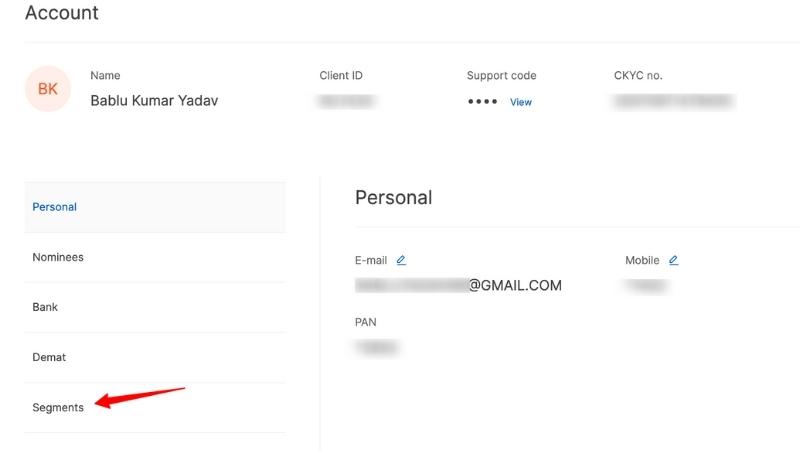

Step 7- Go to Segments

Step 8- Toggle off the NSE – Futures & Options icon

Step 10- Confirm again to deactivate the account

That’s all; your F & O account has been successfully deactivated. Now, you can only enable it after 12 hours.

Similarly, you can toggle on the Futures & Options icon to enable it again after 12 hours.

Also Read: How To Close Zerodha DEMAT Account Permanently

Why Should You Deactivate Your Futures and Options Account?

If you don’t want to trade Futures and Options, then disable your F & O account. That’s the obvious reason.

But, if you’re making losses in F & O, then it can help you.

Do you know that 90% of Options buyers lose money?

Market greed is the primary reason for losses in F & O trading. I’m saying this with full responsibility because I have personally experienced this.

After 3-months of Options trading, I realized that most of my morning trades were profitable, and because of overtrading, I make losses at the end of the day.

Despite all efforts, control of overtrading was unsuccessful. So, I figured out a way to build my psychology to stop overtrading- deactivate my F & O for 12 hours.

Thanks to Zerodha for providing this great feature. Now, I can sit, relax, and watch candlesticks on the chart.

So, if you’re making losses because of overtrading, then deactivate your Zerodha’s Futures and Options account for 12 hours.

You can enable it the next day to trade again. Enjoy your profit!

What Are The Brokerage For Futures and Options in Zerodha?

Zerodha is the biggest discount broker in India that allows intraday and positional trading in the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Zerodha has a transparent brokerage system, and they charge INR 20 per order or 0.03% (whichever is lower) for Intraday and Futures and Options.

It means if you’re making positions in F & O, then you have to pay INR 40 brokerage (Rs. 20 for Buying + Rs. 20 for Selling), and above that, you’ve to pay transaction charges and taxes to the government.

Zerodha offers free brokerage on carry-forward positions (delivery orders) in equity and mutual funds.

How To Trade Futures and Options in Zerodha?

If you have recently created a DEMAT account with Zerodha and planning to trade F & O contracts on the National Stock Exchange, then you need to enable the NSE- Futures and Options segment from account settings.

Similarly, if you want to trade Future and Options contracts of the Bombay Stock Exchange, then you need to enable the BSE- Futures and Options segment from your Zerodha account settings.

To activate the Future and Options segment for the first time, Zerodha may ask you to submit income proof.

You can download your last 6 months’ bank statement in PDF format and submit it to Zerodha.

After that, you can add Futures and Options contracts for Indexes or Stocks in your watchlist to trade.

How To Activate F&O in Zerodha Without Income Proof?

Zerodha asks for the last 6-months bank statement as income proof for Future and Options activation. However, if you don’t want to submit your bank transaction history to anyone, you can submit your salary slip as income proof.

According to your yearly income, Zerodha provides your margin for trading. So, you should submit all your bank account statements for a bigger margin.

Conclusion

Options trading is very risky; you should calculate your daily risk and plan accordingly. Always focus on risk management and money management, and build your psychology to cut your positions when decided stoploss hits.

If you’re continuously making losses in Options trading, you better work on your position sizing, sharpen your technical analysis, and avoid overtrading. You can also disable your F & O segment in Zerodha online to stop overtrading.